Let’s face it – Canadian immigration instructions are often scant on the little details and nuances.

Whether it is for a Temporary Resident Visa (“TRV”) or a Study Permit (“SP”), there are immigration websites that provide confusing, and often contradictory messaging.

Do you need provide 3-month transaction record or a 6-month bank statement (or both)? Do you provide 4-months worth of bank statements? Should you convert your savings or investments into something more liquid? Do you need to provide income tax returns for yourself or parents?

The first step of course is to check the Visa Office specific instructions for the specific application you are submitting. Then, check what the overall requirements are for your categories by browsing IRCC’s website (note: some pages are way out of date). Always do, what you can, to fit what is recommended by the end decision-maker.

The reality is, however, refusals will come more frequently in the coming years because of proof of funds. Not because you don’t have the funds, but because of the word ‘proof.’

The Federal Court decision in Kita v. Canada (Citizenship and Immigration), 2020 FC 1084 (CanLII), sets up this likelihood by taking the analysis out of R. 220 of the Immigration and Refugee Protections Regulations (IRPR) to the R.216 IRPR analysis of whether an individual will leave Canada at the end of their authorized stay.

Justice Pallotta writes:

[17] Ms. Kita submits that the Officer relied on an inaccurate factor by underestimating her available funds, which were not $15,000 USD as noted in the GCMS, but exceeded $30,000 USD. The respondent submits there was no error, and argues it is clear from the Officer’s notation

“[Ms. Kita] and spouse applying for study permit and open work permit respectfully provided bank letters showing savings of over 15,000 US funds”that the Officer simply meant to write“respectively”rather than“respectfully”. To this point Ms. Kita responds that the reference to $15,000 USD is certainly the wrong figure, and a reviewing court should not guess what the Officer meant. I am not persuaded by Ms. Kita’s arguments. The Officer’s notes above clearly refer to bank letters. The record includes two bank letters from Ms. Kita and her husband, each reflecting savings of about $15,000 USD. Furthermore, a field in the GCMS record titled“Available Funds”indicates $40,000 CAD, which is roughly equivalent to $30,000 USD and consistent with both Ms. Kita’s application form, which indicates available funds of $40,000 CAD, and the covering letter to Ms. Kita’s application, which indicates available funds of $42,000 CAD. I am not satisfied that Officer underestimated Ms. Kita’s available savings.[18] Ms. Kita submits that the unknown provenance of her available funds was an irrelevant factor, as the IRPR does not require applicants to prove the provenance or origin of their funds. Section 220 of the IRPR only requires proof of sufficient funds for the program of study and Ms. Kita states that she provided such proof: in addition to savings of over $30,000 USD, Ms. Kita had already paid a part of her tuition, she and her husband planned to stay with family who would cover the accommodation costs, and her husband planned to work during their stay as a skilled tradesman. Thus, in raising the issue of the origin of the funds, Ms. Kita argues that the Officer imposed an arbitrary requirement, and erred by misapplying the criteria that were relevant to the exercise of discretion: Little Sisters Book and Art Emporium v Canada (Commissioner of Customs and Revenue), 2007 SCC 2 at para 93.

[19] Furthermore, Ms. Kita argues the Officer fettered discretion by drawing an adverse inference from a concern, which was never articulated, that she and her husband obtained their savings by dishonest means as opposed to family generosity or fiscal responsibility, particularly when there were no grounds to question the provenance of the funds based on the evidence (i.e. that Ms. Kita’s family are relatively affluent land owners in Albania, that she and her husband were living with his parents, and that her husband has a skilled trade). Ms. Kita contends the adverse inference was invalid and constitutes a defect in the logical process supporting the decision: Canada (Director of Investigation and Research) v Southam Inc., 1997 CanLII 385 (SCC), [1997] 1 SCR 748 at para 56.

[20] In my view, the Officer did not suggest that Ms. Kita and her husband obtained their savings through dishonest means. Also, the Officer did not refuse Ms. Kita’s application for failing to meet the requirements of section 220 of the IRPR, and the fact that section 220 only requires proof of sufficient funds does not necessarily render the origin of the funds irrelevant to the criteria under subsection 216 of the IRPR. Ms. Kita has not established that the IRPA and IRPR preclude an officer from considering the amount and origin of funds when deciding whether an applicant will leave Canada at the end of their stay. It was reasonable for the Officer to consider such factors in this case.

What Justice Pallotta’s decision opens the door for is refusal on the ground of proof of finances, even if the finances themselves meet R.220 because the evidence needed to meet the threshold could ALSO be relevant in an R. 216 IRPR analysis. One can think of ways this might apply:

- Funds sufficient, but from a third-party in Canada that might provide incentive for the individual not to leave or at least raise a possibility;

- Funds are tied to a loan or land mortgage from country of residence, but individuals appear to be leaving, giving rise to issue of ties and whether these will be maintained after the TRV/SP is approved;

- Funds that are tied in non-liquid real estate or investments that lack clarity for their accessibility;

- Funds sufficient for one year, but not of an amount for whole duration of studies – which leads an Officer to believe that individual will not leave given they need funds to pay for further studies; and

- Applicant themselves have no funds and there could be concern that funder may terminate relationship or pull resources.

While for many of these cases, an applicant may have a strong argument for judicial review given IRCC’s lack of instructions detailing these considerations and the tendency for refusal letters and Global Case Management System’s (GCMS) notes not to spell out the shortcomings, this could change soon. A simple change to Canadian immigration’s program delivery instructions on ‘how to prove finances’ or amendments to the refusal letters to reflect insufficiency of evidence could render refusals very much reasonable.

For example, if an ‘uncle’ or more distant third-party family member were supporting one’s studies in Canada, but the letter did not sufficiently detail the family relationship or explain why funds were being supported (for example, with a clear message that they are unencumbered) it would be reasonable to suggest that the evidence is insufficient that the funds are actually available in the statement amount to the student. While there could be credibility concerns, that require a request letter or procedural fairness letter (“PFL”), the language of insufficiency, an applicant’s requirement to put their best foot forward, and the limited procedural fairness rights of international students will always be at play.

Five Quick Tips for Applicants

In that light, I thought I would provide five quick tips for applicants. These go beyond what IRCC recommends and are steps we engage at our office when preparing study permit applications.

- Don’t just show bank accounts, cover an explanation letter – this letter should prove the relationship with the funder and demonstrate how (including how much) of the funds are being supported and why;

- Rely on more than one source – especially if IRCC Officers are refusing because the funds are not the applicants or their direct family members (again, a reviewable error on current instructions), utilizing a combination of both the Applicant’s funds, and supporters, any which

- Show as much as possible – unfortunately, this one area where modesty isn’t a good thing. Many individuals get triggered for financial review because the amount they show on the IMM forms barely covers tuition, even though they may have already paid tuition and have additional funds elsewhere. If you are able to show the funds for the duration of studies, show it. Don’t leave it up to interpretation.

- Explain the origin/liquidity of the funds (where possible, and especially where investments)- to make it easier for the Officer, get ahead of the legitimacy of the funds by showing where it is from (family savings, small business savings, etc.) or if they are investments, giving some sense of when they can be withdrawn and how quickly.

- Use Tables! – the reality of the upload size limits and volumes provided by online applications make it nearly impossible to present finances in the way you want to. You may have three financial supporters, all with their own bank statements, or individually your funds may be separated into numerous accounts. Officers are not afforded the time to go through each month’s statements looking for the end balance. Utilizing tables – in your cover letter, as a cover to the upload, and in indexes are good ways to demonstrate finances.

Contact Me About Your Refusals on Finances

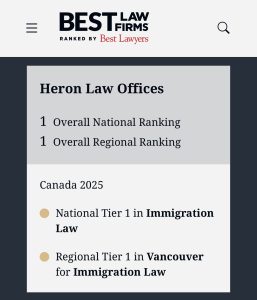

We are currently in the process of litigating (judicial reviewing) cases where insufficient finances have been the ground for refusal. Please email me me at info@heronlaw.ca and we will try and help you.